RoboForex Broker Review

This review is a result of months spent with the brokerage firm, RoboForex. The review team had performed an exhaustive examination of all the offers and services provided by the company.

The review team had looked into the facets below to render a pointed and informed assessment of RoboForex’s overall capabilities:

1. The firm’s regulatory status

2. The trading instruments clients are given access to

3. The trading accounts that the firm provides

4. The trading software that the firm offers

5. The Spreads, Leverage, and Fees charged by the firm

About RoboForex

Probably one of the more respected brokerages in the trading industry, the RoboForex Group operates through two separate entities globally, RoboForex the one that has a more global scope and RoboForex Ltd. which has specialized regulations within its base of operations in Cyprus.

Worthy of note, RoboForex Ltd. supports countries that are a part of the European Union (EU) and the European Economic Area (EEA).

RoboForex was established back in 2009 and has since then gathered a number of clients internationally. The firm is recognized by its patrons and the entire online trading industry for being a brokerage that offers innovative solutions for all its clients’ trading needs.

One of the most notable offers from the brokerage is ContestFX, its own contest project. The competition is administered through RoboForex’s Demo Account which is held weekly and monthly with the prizes deposited to the clients’ real trading accounts. This is seen by the review team as completely enticing as it allows clients to already start earning without having to delve early into actual trading through their own live accounts without being compelled to make deposits.

All of RoboForex’s trading operations are overseen by the Cyprus Securities and Exchange Commission (CySEC) and The European Securities and Markets Authority (ESMA). These two regulatory bodies allow for greater legitimacy, providing greater security for RoboForex’s clients. In addition, being an international entity, it also takes cues from the International Financial Services Commission (IFSC), Belize.

Preliminary Findings

RoboFOrex is noted to foster good trading conditions through its provision of Negative Balance Protection and the offering of an additional Civil Liability Insurance.

Add these to ContestFX, traders are given much to laud about RoboForex.

Offers and Services

Traders are given access to different trading markets, specifically the Foreign Currency Exchange, Stocks, Indices, ETFs, Soft Commodities, Energies, Metals, and Cryptocurrencies markets. All these traders can buy and sell across its 6 account types for a minimum deposit of only $10.

RoboForex clients are allowed to trade with such instruments through the accounts’ base currencies, namely, the US Dollar, the Euro, the Russian Rubble, and the Renminbi. Gold is also allowed for transactions alongside the Bitcoin.

RoboForex assists its traders who are accustomed to making high-leverage trades so that they may be able to make the best out of such. The brokerage permits its clients greater gains through its tutelage of how to make use of leverages correctly and more efficiently, given that trades of great gains tend to have higher risks.

RoboForex takes cues from its regulatory status to establish the leverages that it would provide its clients.

Traders through the firm would be allowed to apply for a leverage of 1:400, 1:500, and even up to 1:2000 should they confirm their tenure and professional status.

If the client resides in any of the European regions, then he or she will be given the opportunity to trade through RoboForex’s Cyprus arm, thus following the stringent regulations of the ESMA. What this means for the client is that they are able to experience a maximum ratio of 1:3 on Forex and 1:5 for Cryptocurrencies.

Available Trading Accounts

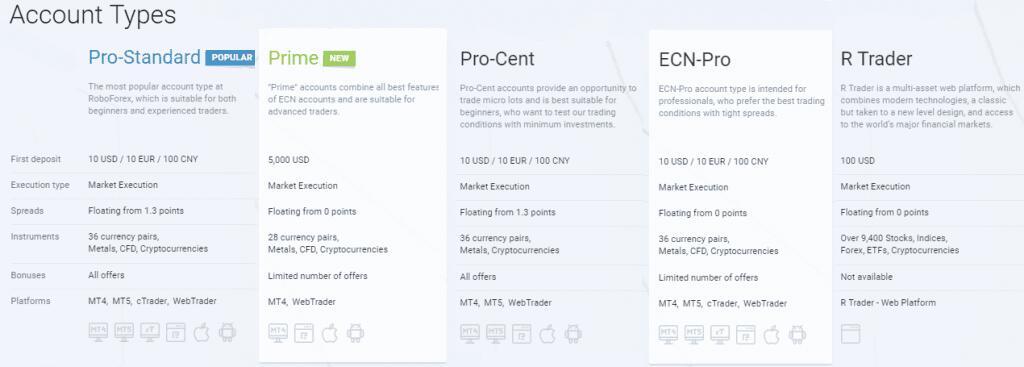

As already mentioned, RoboForex offers six types of accounts, the Pro-Standard Account, Prime Account, Pro-Cent, ECN-Pro, and the R-Trader Account. The offerings of each ae detailed in the table below:

Through the Standard Account the fees are built into the floating spreads. The pips for such starts from 1.3 pips with no extraneous charges.

The Cent Account also offers the same. The R Trader, ECN, and Prime Accounts, on the other hand, are pegged at 0 pips.

Deposits and Withdrawals

Traders are allowed to make deposits through 20 different options such as bank transfers, card payments, and known e-wallets like Skrill, Neteller, and FasaPay.

With some of the deposit methods mentioned, when used for withdrawals like SkrilL, a processing fee of 1% will be added. With Visa, a percentage of 2.6% plus $1.6.

Offered Trading Platforms

While RoboForex also offers its proprietary platform for trading, RTrader, it does well by offering other industry-trusted platforms like MetaTrader 4, MetaTrader 5, and cTrader.

All these platforms are available through a web application and a mobile application. The third party platforms are known for their efficiency through their provision of highly intuitive interfaces and customizable charts and tools.

RTrader is also known for easy navigation without the need of installing any additional software.

Trade With RoboForex Today!

The points discussed throughout the review paint a positive image for RoboForex. The following aspects have been found to create good trading conditions:

1. The wide range of trading instruments available to its clients

2. The trading accounts that offer a number of advantageous features

3. The efficient trading platforms that it offers

4. The competitive Spreads that come with its trading accounts